Basics

This class covers all the fundamentals you’ll need to know to trade effectively. Key concepts introduced:

- what a portfolio is

- what margin is

- how to think about setting goals for trading

- trading strategy definition and use

- key events that can influence the price of stocks (and, consequently, their options)

Portfolios

A portfolio is simply a collection of cash and non-cash assets, like real estate, equity in a business, and securities. Trading as covered on this site is basically making decisions about securities to buy and sell: what to buy, when to buy, and the same for selling.

Composition

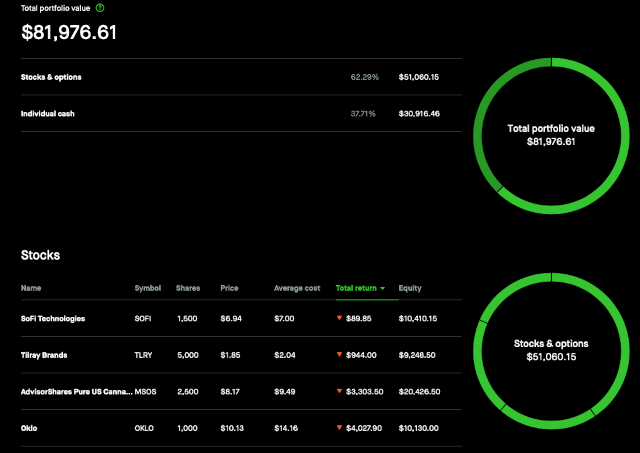

Most brokers will provide visualizations and other presentations of your portfolio in terms of its composition: percentages of different kinds of assets which comrpise your portfolio.

The above image is a snapshot from one of the brokers I use in my trading activities. Other brokers’ applications may not show the same exact information, and the information may be formatted differently, but any reputable one will have some way to view the distribution of cash and securities in percentages of your whole portfolio.

As you trade stocks and options, the composition of your portfolio changes. You’ll use some of your cash to buy securities, and receive cash when you sell them. At the same time, the securities you own will fluctuate as you buy and sell them.

Goals and Basic Management

Part of trading is learning to manage your portfolio. A separate class on this which goes into much more depth is located here. For now, some basics are useful to understand for the rest of this discussion.

Margin

Many brokerages offer something called “margin”. Basically this is a loan that uses your overall portfolio as collateral. “Collateral” is just an asset, like a house or a stock, that lenders are permitted to take if someone they loan money to fails to meet their obligations, such as repayment of a loan or maintaining a minimum amount of cash in an account.

Brokers have different policies regarding how much margin they will provide and under what terms. Typically you can borrow up to 50% of your portfolio’s value. For example, if you have $2000 in cash and $1000 worth of stocks, you can borrow an additional $1500 from your broker to use in other trades.

Equity

When using margin, you have to be mindful of the equity in your account. Equity is the value of the stock you own that is fully paid.

Suppose your portfolio value is $5000: $2000 in cash and $8000 in stock. You use $2000 of your cash and $2000 in margin to buy $4000 worth of stock. Your portfolio value is now $12000, all in stock. Since you borrowed $2000 in margin, your equity is $10000. Your equity ratio is the ratio of your equity to the margin borrowed: in this case $10000 / $12000, or about 83%.

If the value of your stocks falls, your equity decreases–and therefore so does your equity ratio.

Maintenance

All brokers have maintenance requirements: the minimum equity in your portfolio required to sustain the margin. The maintenance requirement is typically listed as a minimum equity ratio, and is usually around 30%.

If your equity ratio falls below the maintenance requirement, your broker will issue a margin call: a demand for you to deposit cash or securities to bring the ratio back to the maintenance level.

Calculating the minimum portfolio value for maintenance

This section is a bit “mathy”. If you want to know the value of your portfolio which will cause a margin call this section will be useful. You can simply rely on your broker’s data to keep an eye on it.

The minimum portfolio value before your broker will issue a margin call is

where M is the borrowed margin and R is the margin requirement, expressed as a number between 0 and 1 (e.g. if the requirement is 35%, R = 0.35).

If you want to see how the formula is computed, expand the dropdown below.

Provided you don’t make any other changes (e.g., adding cash, trading more stock), you can know the value of your portfolio that will trigger a margin call.

Example calculation

Suppose you’ve constructed a portfolio of $15000 worth of stock using $3000 in margin. Calculate the value of your portfolio that will trigger a margin call if the maintenance requirement is 35%.

In this case,

When your portfolio value falls below $4615.39, your broker will make a margin call.

Increased Risk of Loss

When you borrow on margin, you risk losing more than your total equity. If you buy $5,000 in stock with $4,000 cash and $1,000 margin, and the stock price drops to zero, you still owe the broker $1,000, because your portfolio value is now -$1,000.

In scenarios where your portfolio value drops below the margin you’ve borrowed, brokers will demand that you deposit cash, not stock, to repay the amount (or partial amount) you borrowed and then recalculate the new maintenance portfolio value after the repayment.

Notice that in the above discussion you had $4,000 in cash in your broker account at the beginning. When the stock dropped to zero, you still owed $1,000. You lost your initial $4,000 and had to pay the broker an additional $1,000 to cover your debt.

You lost more money than you started with. This is a fact about margin: you could lose more than the total deposits you’ve made. So think carefully before trading on margin.

Margin Call Example

Let’s say you have $1000 in cash and $4000 in stocks. You borrow $1000 to buy $2000 worth of stock. Your equity is $5000 ($4000 of stock, plus the $1000 in stock you purchased with your cash), and your portfolio value is $6000. Your equity ratio is $5000 / $6000, or 83%. Your broker has a 30% margin requirement.

Suppose the stocks you own fall in value to $5000. Now your equity is $4000 (the stocks fell by $1000–that’s taken from your equity only, not the margin you borrowed). This gives you an equity ratio of 80%. At this point, the broker will do nothing, because your equity ratio of 80% is more than the maintenance requirement of 30%.

Now suppose the stock value falls an additional $3700, leaving you with a portfolio value of $1300. Your equity is now $300, and your equity ratio is $300/$1300, or 23%. Your broker will now issue a margin call, because your equity ratio of 23% is below the maintenance requirement of 30%.

You have two choices:

deposit cash You need 30% of $1300 in total, or $390, so you would have to deposit $90 in cash.

deposit stock

30% of the new value of your stocks must be in stock you own. When you transfer stocks in, both the value of the stock you own and the total value of your portfolio increases, so you must add enough to make the ratio correct. This value is calculated by dividing the shortfall ($90, in this case) by the value the stock has for margin,

So you’d need to add $128.58 worth of stocks to satisfy the margin call.

Once you do this, your portfolio value is $1428.58, and your equity is $428.58, for a ratio of 30%.

Technically, you can do any combination of the above. The value of stock you transfer in must cover the difference between your margin requirement after you deposit cash, adjusted by the

Exercises

-

You have $5000 in cash and $10000 in stocks. You want to buy $7000 worth of stock. a) how much margin must you borrow? b) if the broker’s maintenance requirement is 30%, at what value of your stocks will your broker issue a margin call?

-

A broker has a margin requirement of 25%. If you construct a portfolio of $100,000 with $25,000 in margin, and the portfolio drops to $30,000 in value: a) how much cash should you put in to meet the maintenance requirement; b) what is the cash value of stock you’d have to put in?

-

You build a portfolio worth $50,000 with $10,000 in margin. The company issuing the stock you bought suddenly is discovered to have engaged in fraud, and is actually worth nothing–its stock price drops to $0. How much cash do you have to give the broker?